UK government borrowing

Your Money, Their Debt

What Rising UK Government Borrowing Really Means for Your Savings

Why This Isn't Just Westminster's Problem – It's Yours Too

Ever scrolled past a headline about the UK government borrowing billions and thought, "That's just for the economists in Westminster, right?" It's easy to feel disconnected from those big numbers. But here's the honest truth: that borrowing isn't just some abstract figure. It's a powerful current that quietly ripples through your savings account, nudges your mortgage payments, shapes your pension pot, and even influences the price of your weekly shop.

With the national debt hitting near-record highs and the cost of borrowing climbing, it's time to pull back the curtain. Let's unpack what this rising UK government borrowing actually means for everyday savers like you – and, more importantly, what smart steps you can take to protect and grow your money.

The Money Pit: Where We Stand Right Now

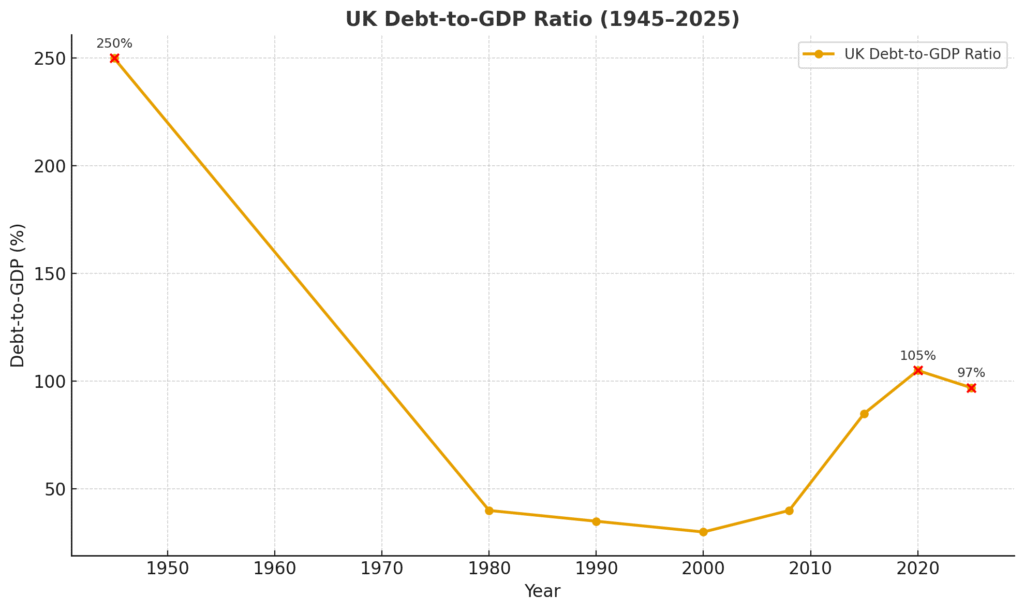

Let's talk numbers, because they matter. Right now, the UK's national debt is a staggering £2.5 trillion – that's almost everything the country produces in a year (around 97% of our GDP). And even the independent watchdogs, like the Office for Budget Responsibility (OBR), are waving red flags about how much it's costing us just to pay the interest on that debt, especially with interest rates staying stubbornly high.

It's not just old debt, either. The government's got huge bills to pay – think our NHS, pensions for our parents, and fixing our roads. These costs are only going up. And when the economy isn't growing as fast as we'd like, the government has to borrow even more just to keep things ticking over.

Now, debt isn’t new. We’ve seen these numbers jump around before. After World War II, it was a massive 250% – but we grew our way out of it over many years. In the ’90s and early 2000s, it felt much more manageable, around 30-40%. Then came the 2008 financial crisis, pushing it past 80%, and the pandemic really put the pedal to the metal.

Today, we’re nudging 100% of GDP. Historically, that’s not the highest we’ve ever been, so it’s not a full-blown crisis yet. But it does mean the government’s hands are tied. They don’t have much wiggle room. Think of it this way: they can keep paying the bills for now, but don’t expect any big spending sprees or massive tax cuts anytime soon.

And here’s why this really hits home: when the government needs money, they’re essentially competing with you and your business for it. When they sell ‘gilts’ (that’s just fancy talk for government IOUs), it has a knock-on effect on everything from how much you pay on your mortgage to the interest you earn on your ISA savings.

The Ripple Effect: What It Means for Your Money

So, how does all this government borrowing actually hit your wallet? Let's break it down:

Your Savings Accounts

Your Mortgage

Your Pensions and ISAs

The Economic Domino Effect: How Government Debt Shapes Your Life

Let's take a step back and see the bigger picture. How does all this national debt, government borrowing, and the way the country manages its money actually trickle down into your daily life? It's a bit like a chain reaction:

1. Interest Rates – The Cost of Money

When the government needs to borrow a lot, they have to make it attractive for people and institutions to lend them money. This means offering higher returns on their ‘gilts’ (those government IOUs). And guess what? This directly influences what the Bank of England does with its own interest rates. So, more government borrowing often means interest rates stay higher for longer.

- For your savings: This can be a silver lining, as you might see better rates on your fixed-term savings accounts.

- For your borrowing: On the flip side, it means your mortgage, personal loans, and credit card debt will likely remain more expensive.

2. Taxation – Who Pays the Bill?

Someone has to pay for all that debt, right? And the interest payments alone are a huge and growing bill for the government. This puts immense pressure on the Chancellor to find ways to bring in more money. How do they do it? It could be through:

- Stealth taxes: Like freezing tax thresholds, which means more of your earnings get taxed as your wages slowly rise with inflation.

- Direct increases: Such as higher National Insurance contributions.

- Targeted changes: Perhaps tweaks to things like Capital Gains Tax or Inheritance Tax. Ultimately, it’s us, the taxpayers, who end up footing the bill.

3. Inflation – Your Money's Shrinking Power

If the government keeps borrowing heavily instead of tightening its belt (either by cutting spending or raising taxes), it can pump too much money into the economy. This can make demand for goods and services run “hot,” which is a fancy way of saying it pushes prices up. And when prices go up, that’s inflation. Inflation is the silent thief that erodes the purchasing power of your cash savings. It means you need to be even smarter about where you put your money, looking for investments that can actually beat those rising prices, like certain stocks or funds.

Who Feels the Pinch – And Who Might See an Opportunity?

So, who exactly gets hit by all this, and who might actually benefit? It’s not a one-size-fits-all situation:

- Homeowners & First-Time Buyers: If you own a home or dream of buying one, this is big. More government borrowing often means higher mortgage rates. That makes it tougher to afford a new place or means your monthly payments could jump when your current deal ends.

- Renters: Don’t think you’re immune. If landlords face higher costs for their own mortgages, they might pass those on to you in the form of higher rents.

- Savers: On the surface, higher interest rates on your savings accounts look great! But remember that sneaky inflation? It’s still eating away at your money’s real value. So, while the number in your account might grow, what it can actually buy might not.

- Investors: For those with money in the markets, government borrowing can create some choppy waters. It can lead to market wobbles, which means more risk, but also potential opportunities for savvy investors to buy low.

- Pensioners: If your pension fund holds a lot of government bonds (gilts), you might see a temporary dip in its value when interest rates rise. However, if you’re looking to buy an annuity, higher interest rates often mean you’ll get a better income from it.

Your £20,000 ISA: Fighting Back Against Inflation

Here’s a crucial point for every saver: your ISA allowance. It’s stuck at £20,000 until 2030. Now, £20,000 sounds like a lot, but think about it: what £20,000 could buy you back in 2017 is a lot more than it can buy today. That’s inflation quietly chipping away at its value. And with all this government borrowing potentially fuelling more inflation, that erosion only gets worse.

This means making the absolute most of your ISA allowance is more vital than ever. Especially a Stocks and Shares ISA. It’s one of your best weapons against your money losing its power over the long haul, giving it a fighting chance to grow faster than rising prices.

Smart Moves: How to Protect and Grow Your Money

So, with all this going on, what can you actually do? Here are some practical steps to help your money work harder for you:

- Grab Those Good Savings Rates: Don’t let those elevated interest rates pass you by! If you’ve got cash sitting around, now might be a smart time to lock some of it into a fixed-term savings account. You’re getting a better return than we’ve seen in years.

- Make Your Stocks & Shares ISA Work Harder: Remember how inflation eats away at cash? Historically, investing in company shares (equities) through a Stocks and Shares ISA has been one of the best ways to outpace inflation over the long run. It’s crucial for anyone looking to grow their wealth in these uncertain times.

- Don’t Put All Your Eggs in One Basket: Think about spreading your money across different types of investments – a bit of cash, some shares, maybe some bonds. This ‘diversification’ helps protect you if one area takes a hit.

- Keep an Eye on the News (The Financial Bits): You don’t need to become an economist, but paying a little attention to what the government is planning (Budgets), what the OBR says, and what the Bank of England is up to can give you early clues about what might be coming down the line for your finances. Small signals can often lead to big changes.

What's Next for Your Wallet?

The future is always a bit hazy, but here are three big things that will really shape how government borrowing affects your money:

- Who’s in Charge Next? The political choices made by the next government will be huge. Will they decide to raise taxes, cut public spending, or just keep borrowing more? Each path has a different impact on your finances.

- The Mood of the Money Markets: If the big global investors start to lose confidence in the UK’s ability to manage its finances, they might demand even higher returns to lend us money. That could send borrowing costs (and your mortgage rates!) spiralling even further.

- What’s Happening Globally: We’re not an island, financially speaking. If interest rates or bond yields start climbing in big economies like the US or Europe, those ripples will inevitably reach our shores, affecting everything from your savings rates to your mortgage payments.

Frequently

Asked Questions

That's a really smart question, and it gets to the heart of the matter! While it's true that banks are offering better rates on savings accounts now (often because the government's borrowing pushes rates up), if inflation is still high – say, 3-4% – your money might still be losing its buying power. So, the number in your account might grow, but what it can actually buy might not be keeping pace. This is why we talk about "real" returns versus just the headline interest rate.

It's a valid concern, especially for homeowners and first-time buyers. When the government borrows heavily, it often pushes up the cost of money across the board, including for mortgages. This can make new mortgage deals more expensive and affordability tougher. While it's hard to predict the future definitively, understanding this link means you can be prepared for potentially higher costs and explore options like fixed-term deals when they're favourable.

You're not wrong to feel that way. The government has a massive bill to pay just on the interest for its debt, and that bill is growing. This puts real pressure on Chancellors to find ways to raise money. This could mean "stealth taxes" like frozen tax thresholds (meaning more of your income gets taxed over time), or even direct increases to things like National Insurance. Ultimately, yes, taxpayers often end up shouldering a significant part of the burden to service the national debt.

While there's no single magic bullet, if we had to pick one crucial strategy, it would be to make the absolute most of your ISA allowance, especially a Stocks and Shares ISA. Cash savings are vulnerable to inflation, which is magnified by government borrowing. Historically, investing in equities through an ISA has been one of the most effective ways to help your money grow faster than inflation over the long term, giving your wealth a fighting chance against rising prices.